How Much Money Are We Required to Contribute?

Originally, I started writing this to be posted as a Facebook status message, but then it got a little too long, so I decided to make a blog post out of it.

Let's do a little math. Say for example, we have a call center agent whose salary is P20,000 in a month.

Her mandatory SSS contribution is set to P1,560 per month since her salary bracket is above P15,000 (this is set to be increased come January 2014, by the way). She also has HDMF, PhilHealth and 12% salary taxes to pay. If, for example, she gets off 20,000 clean in a month, that's

12% Tax: Goes to the Bureau of Internal Revenue, which is used to pay ordinary Government employees (their wages aren't much, mind you, I would know), the Police, the Military, the Congress, the Senate, the President, etc. There's also the Pork Barrel, the DAP, etc.

Social Security System:

PhilHealth: For a salary base of 20,000, expect a P500 deduction from your payroll monthly(http://www.philhealth.gov.ph/partners/employers/contri_tbl.html)

HDMF:

Now let's say we have 1,000 agents (this is not uncommon in a BPO firm, they usually have more than a thousand employed)

Taxes: 2,400 x 1,000 = P2,400,000 per month collected from ONE company

SSS: 1,560 x 1,000 = P1,560,000 per month collected from ONE company

PhilHealth: 500 x 1,000 = P500,000 per month collected from ONE company

HDMF: 100 x 1,000 = P100,000 per month collected from ONE company

Now let's say we have 20 BPO firms in Luzon.

P4,560,000 x 20 = P91.2M per month collected from 20 companies

Let's see how much money's collected from mandatory deductions if there were 20 more companies from the Visayas and Mindanao regions. That's a total of 60 companies.

P4,560,000 x 60 = P273.6M per month collected from 60 companies

And how many months do we have in a year? 12

P273.6M x 12 = P3,283,200,000 per year

Apparently, there are about 788 call centers in the Philippines and more are popping out. The BPO industry has been keeping our economy afloat, among other things, it's made life easier for employees who can't find a job in their field and it sure proved that Filipinos are fine workers.

I'm not going to continue the computation, because I'm starting to see too many zeroes and just thinking about where all that money could have gone is just making me upset. If you want to continue, go ahead.

What I'm doing here is just provoking you to think about where all your money is going. Most Filipinos get angry because their money is being taken without having a say in it. If you don't agree to these terms, then you don't get hired. If you don't get hired, you don't get paid. If you don't get paid, it's game over for you. Although these deductions are such a pain in the ass, they are needed to keep a country afloat. If not for taxes, we won't be able to afford public services.

Unfortunately, a large portion of our taxes are being used to make corrupt politicians richer instead of using it to invest in new hospital equipment, infrastructure, education for the poor, even providing support for our government employees by educating them through seminars and assisting them with personal development will encourage them to serve the public better.

SSS has been saying for the past few years that in the coming years, they will run out of funds, but if that's the case, how can they afford to give away bonuses in obscene amounts? The fact that they have been predicting their misfortune is just ironic.

PhilHealth's case is the same. HDMF doesn't take too much from you, but no matter how much they take from you, it's still the same case.

And what's sad is that, majority of the contributors do not actually get their money back, or have no idea how to get their money back. That's why there's so much money circulating.

Let's do a little math. Say for example, we have a call center agent whose salary is P20,000 in a month.

Her mandatory SSS contribution is set to P1,560 per month since her salary bracket is above P15,000 (this is set to be increased come January 2014, by the way). She also has HDMF, PhilHealth and 12% salary taxes to pay. If, for example, she gets off 20,000 clean in a month, that's

12% Tax: Goes to the Bureau of Internal Revenue, which is used to pay ordinary Government employees (their wages aren't much, mind you, I would know), the Police, the Military, the Congress, the Senate, the President, etc. There's also the Pork Barrel, the DAP, etc.

20,000 x 0.12 = P2,400

Social Security System:

P1,560

PhilHealth: For a salary base of 20,000, expect a P500 deduction from your payroll monthly(http://www.philhealth.gov.ph/partners/employers/contri_tbl.html)

HDMF:

P100

Tax + SSS + PhilHealth + HDMF = Total Deductions

2,400 + 1,560 + 500 + 100 = 4,560

20,000 - 4,660 = 15,440

Now let's say we have 1,000 agents (this is not uncommon in a BPO firm, they usually have more than a thousand employed)

Taxes: 2,400 x 1,000 = P2,400,000 per month collected from ONE company

SSS: 1,560 x 1,000 = P1,560,000 per month collected from ONE company

PhilHealth: 500 x 1,000 = P500,000 per month collected from ONE company

HDMF: 100 x 1,000 = P100,000 per month collected from ONE company

Total Deductions Remitted = P4,560,000

Now let's say we have 20 BPO firms in Luzon.

P4,560,000 x 20 = P91.2M per month collected from 20 companies

Let's see how much money's collected from mandatory deductions if there were 20 more companies from the Visayas and Mindanao regions. That's a total of 60 companies.

P4,560,000 x 60 = P273.6M per month collected from 60 companies

And how many months do we have in a year? 12

P273.6M x 12 = P3,283,200,000 per year

Apparently, there are about 788 call centers in the Philippines and more are popping out. The BPO industry has been keeping our economy afloat, among other things, it's made life easier for employees who can't find a job in their field and it sure proved that Filipinos are fine workers.

I'm not going to continue the computation, because I'm starting to see too many zeroes and just thinking about where all that money could have gone is just making me upset. If you want to continue, go ahead.

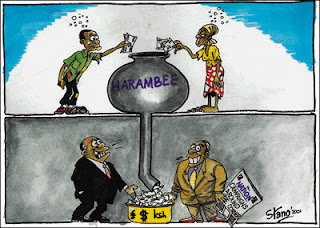

What I'm doing here is just provoking you to think about where all your money is going. Most Filipinos get angry because their money is being taken without having a say in it. If you don't agree to these terms, then you don't get hired. If you don't get hired, you don't get paid. If you don't get paid, it's game over for you. Although these deductions are such a pain in the ass, they are needed to keep a country afloat. If not for taxes, we won't be able to afford public services.

Unfortunately, a large portion of our taxes are being used to make corrupt politicians richer instead of using it to invest in new hospital equipment, infrastructure, education for the poor, even providing support for our government employees by educating them through seminars and assisting them with personal development will encourage them to serve the public better.

SSS has been saying for the past few years that in the coming years, they will run out of funds, but if that's the case, how can they afford to give away bonuses in obscene amounts? The fact that they have been predicting their misfortune is just ironic.

PhilHealth's case is the same. HDMF doesn't take too much from you, but no matter how much they take from you, it's still the same case.

And what's sad is that, majority of the contributors do not actually get their money back, or have no idea how to get their money back. That's why there's so much money circulating.

Comments

Post a Comment